Offshore Company Formation: Vital Actions for Global Development

Offshore Company Formation: Vital Actions for Global Development

Blog Article

Unveiling the Conveniences of Opting for Offshore Company Development

Checking out the realm of offshore business formation unveils a myriad of benefits that can considerably impact services and individuals alike. The concept of setting up a company in a territory outside one's home nation frequently sparks curiosity and intrigue as a result of the potential advantages it uses. From tax benefits to improved property defense, the allure of overseas company development hinges on its capability to enhance financial techniques and broaden global reach. However, beyond these surface-level benefits, there are nuanced variables at play that make this alternative an engaging choice for numerous.

Tax Obligation Benefits

In addition, overseas firms can involve in tax obligation preparation methods that might not be offered in their residential nations, such as utilizing tax treaties between territories to reduce withholding taxes on cross-border deals. This flexibility in tax obligation preparation enables organizations to enhance their global operations while handling their tax obligation exposure properly.

Additionally, overseas business can profit from property protection benefits, as properties held within these entities might be shielded from specific lawful cases or creditors. This added layer of security can safeguard company assets and preserve wide range for future generations. In general, the tax advantages of developing an overseas business can supply businesses a competitive side in today's international industry.

Asset Defense

Enhancing the protection of organization properties through critical planning is a key purpose of offshore business development. Offshore entities supply a durable structure for protecting properties from potential risks such as suits, creditors, or political instability in domestic territories. By establishing a business in a secure offshore jurisdiction with favorable possession defense laws, businesses and people can shield their wealth from various hazards.

Among the vital advantages of overseas business development in terms of possession protection is confidentiality. Many overseas jurisdictions supply stringent personal privacy regulations that enable business to keep anonymity regarding their ownership framework. offshore company formation. This confidentiality makes it challenging for exterior parties to recognize and target certain properties held within the overseas entity

In addition, offshore frameworks often have provisions that make it tough for lenders to access assets held within these entities. Through legal devices like property defense counts on or specific conditions in business papers, people can include layers of defense to safeguard their riches from prospective seizure.

Boosted Personal Privacy

Additionally, many offshore territories do not need the disclosure of useful owners or investors in public documents, including an extra layer of privacy protection. This confidentiality can be particularly helpful for top-level individuals, entrepreneurs, and services seeking to stay clear of unwanted focus or protect sensitive financial details. Generally, the enhanced personal privacy used by overseas business development can provide peace of mind and a feeling of security for those looking to keep their economic affairs discreet and safe and secure.

Worldwide Market Access

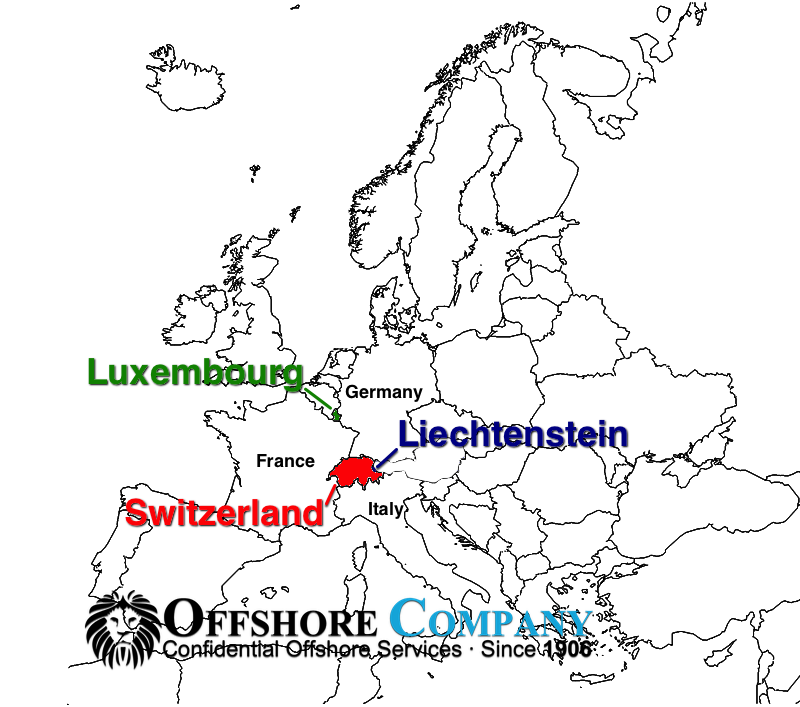

With the facility of an offshore business, businesses obtain the tactical benefit of tapping right into Home Page international markets with boosted simplicity and performance. Offshore business development provides business with the opportunity to access a wider customer base and check out new organization potential customers on a global range. By establishing procedures in overseas jurisdictions known for their business-friendly laws and tax obligation motivations, companies can expand their reach past domestic borders.

International market gain access to with overseas see this website business formation likewise allows organizations to establish global trustworthiness and existence. Operating from a territory that is recognized for its security and pro-business setting can enhance the track record of the business in the eyes of global partners, capitalists, and customers. This raised reliability can open up doors to collaborations, partnerships, and opportunities that might not have been easily obtainable through an exclusively residential business method.

Additionally, offshore companies can gain from the diverse variety of resources, abilities, and market insights readily available in different components of the globe. By leveraging these global sources, businesses can gain an one-upmanship and stay ahead in today's vibrant and interconnected business landscape.

Lawful Compliance

Following legal compliance is necessary for offshore firms to make sure governing adherence and danger reduction in their operations. Offshore business have to browse a complicated governing landscape, frequently based on both regional laws in the territory of unification and the global regulations of the home country. Failing to follow these legal demands can lead to severe effects, including fines, lawsuits, or perhaps the revocation of the overseas company's certificate to operate.

To maintain legal compliance, overseas firms typically engage legal experts with expertise of both the neighborhood laws in the overseas territory and the international laws appropriate to their operations. These lawyers assist in structuring the offshore business in a way that guarantees compliance while taking full advantage of operational performance and success within the bounds of the regulation.

Additionally, staying abreast of developing lawful demands is crucial for offshore business to adapt their operations accordingly. By focusing on legal conformity, overseas business can develop a strong structure for lasting growth and long-term success in the global market.

Verdict

In conclusion, overseas company formation supplies numerous benefits such as tax obligation advantages, asset defense, enhanced personal privacy, international market access, and legal conformity. These advantages make overseas business an eye-catching alternative for services aiming to broaden their procedures globally and optimize their financial techniques. By making the most of overseas business formation, services can improve their one-upmanship and placement themselves for lasting success in the international industry.

The facility of an offshore firm can give considerable tax advantages for businesses looking for to optimize their economic frameworks. By setting up an overseas company in a tax-efficient jurisdiction, services can legitimately minimize their tax liabilities and preserve even more of their profits.

In general, the tax obligation advantages of developing an overseas company can offer organizations a competitive side in today's global marketplace. offshore company formation.

Enhancing the safety of company properties through tactical planning is a main objective of offshore company formation. Offshore company formation gives firms with the chance to access a more comprehensive customer base and explore new organization potential customers on a global scale.

Report this page